Penalty in Failure to get ESI Registration & Returns

In case of any non-compliance by an employer, such as failure to get ESIC employer registration online or not fulfilling ESI return filing procedure, he shall be liable for a fine of INR 10,000/-.

ESI is an autonomous organization under the Ministry of Labor and Employment, Government of India.

10+ Years of Experience

10+ Years of Experience

400 + In-House CAs, CS & Lawyers

10,000+ Pin codes Network in India

Happy Customers

Expert Advisors

Branch Offices

Among Asia Top 100

Consulting Firm

Lowest Fees

100,000 + Clients.

4.9 Customer Rating,

50+ Offices

The Employees’ State Insurance Act, 1948 was enacted by the legislature as an integrated need based on the social insurance scheme. ESIC stands for Employee State Insurance Corporation which is an autonomous body created by the Ministry of Labor and Employment that governs and regulates the Employee State Insurance in India.

Employee State Insurance is a self-financing social security scheme, initiated for the benefits of the Indian workers by providing them with the necessary benefits such as medical facility, monetary facilities and such other benefits from his employer.

This scheme was started for Indian workers. The workers are provided with a huge variety of medical, monetary and other benefits from the employer. Any non-seasonal factory and company having more than 10 employees (in some states it is 20 employees) who have a maximum salary of Rs. 21,000/- has to mandatorily register itself with the ESIC.

Under this scheme, the employer needs to contribute an amount of 3.25% of the total monthly salary payable to the employee whereas the employer needs to contribute only 0.75% of his monthly salary every month of the year. The only exemption to the employee in paying his contribution is whose salary is less than Rs. 176/- per day.

Following entities employing 10 or more employee are liable to get ESI Registration done:-

Above mentioned entities, if employed ten or more employees at any time during the previous year shall mandatory get ESIC Registration. But insurance is deducted for only those employees earning monthly income up to INR 21000 (Basic wages + Dearness Allowance). In a few states, the coverage of ESIC applicability limited to a minimum employee is 20 or more.

ESI scheme provides several benefits to employees covered under ESI with a large network of dispensaries, hospital and medical clinics for providing quick medical care to the insured person. An entity needs to take an ESI registration certificate within 15 days of becoming applicable. However, ESIC regulations are different for different states, and thus, certain rules and provisions vary accordingly.

Sickness benefits are provided to the employee at the rate of 70% of his salary in case such sickness continued for exceeding 91 days in a year, and the same is also certified.

Medical benefits are provided to the insured person along with his family members. Full medical care is provided to all persons registered under ESI and their family members – from the day the person enters insurable employment. There is no ceiling on expenditure on the treatment of an Insured Person or his family member. Medical care is also provided to retired and permanently disabled insured persons and their spouses on payment of a token annual premium of Rs.120/-.

Maternity benefits are provided to the women in the form of paid leaves. Maternity benefit for confinement/pregnancy is provided for three months, which is extendable by further one month on medical advice at the rate of full wage subject to contribution for 70 days in the preceding year.

90% of the salary of the insured person is given to the family of a deceased employee, in case such death occurred while in employment.

Funeral expenses are provided in case of death of any employee covered under ESIC. An amount of Rs.10, 000/- is payable to the dependents or to the person who performs last rites from day one of entering insurable employment.

Medical care and benefits are provided after retirement or in old age.

In case there is any permanent disablement to the insured person, 90% of his salary is provided as a monthly payment in the form of insurance benefit.

An insured person having insurance for more than three years is provided unemployment benefits which become unemployed. Under the Rajiv Gandhi Shramik Kalyan Yojana, unemployment allowance is payable to an insured Person who become unemployed after being insured three or more years, due to closure of factory/establishment, retrenchment or permanent invalidity. The applicable unemployment allowances provided are:

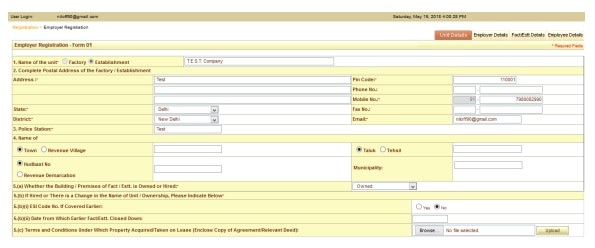

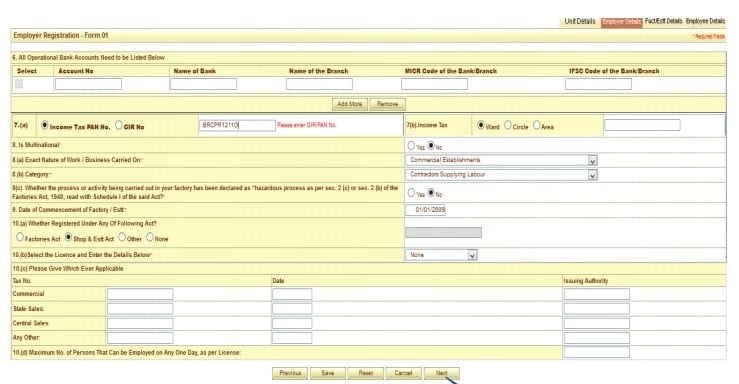

Since the procedure for registration is online, no physical Documents are required to be submitted. Following Documents are required during the online filing of ESI application, which are as follows:-

Factories Act, or

Shops and Establishment Act

Following information/details are also required in addition to the above Document-

In case of any non-compliance by an employer, such as failure to get ESIC employer registration online or not fulfilling ESI return filing procedure, he shall be liable for a fine of INR 10,000/-.

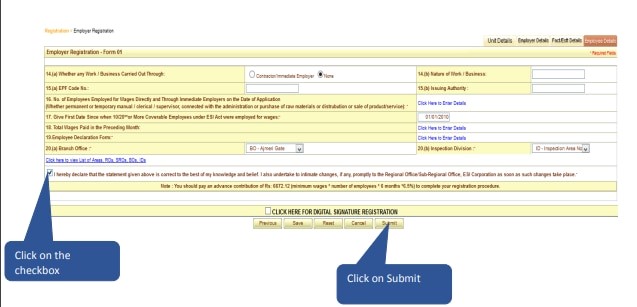

Once the entity is covered under ESIC, it needs to comply with mandatory guidelines as issued by the Act:-

The scheme of ESI is contributory in nature. Both employee’s and employer’s contribution is required at a specific rate. Though, rates are amended from time to time. Following is the monthly contribution rate that is contributed mandatorily by both employer and employee:-

Employee has to contribute 0.75% of his basic wages to the ESI Fund.

Employer has to contribute 3.25% of the basic wage paid to employees.

Employees who earn up to Rs137 of daily average wage are not entitled to be a part of contribution. However, it is the responsibility of the employer to contribute their own shares in respect of these employees.

After the registration ESI Returns have to be filed twice a year. The following Documents are required for the filing of the returns:

Kindly utilize the steps given above to integrate legally and securely an ESI Registration and get the benefits in the form of better-quality insurance assistance. Our Canjain experts will be at your disposal for assisting you with guidance concerning ESI Registration and its compliance for the smooth functioning of your company in India. Canjain professionals will assist you in planning seamlessly at the least cost, confirming the successful conclusion of the process.

It is advisable that an attorney with “Insurance experience” must be appointed to overwhelm many of the potential pitfalls that creep around within ESI Registration and to understand the requirement in detail. The elementary information would be mandatory from your end to start the process. The Attorney will begin working on your request once all the information is provided, and the payment is received.

We make technical compliance certifications effortless and convenient.

Clients Worldwide

By 42842+ Customer

Industry Professionals

Guaranteed